In this article, learn how to set up your:

- Banking information (used for payouts)

- Payment multiplier (used to hold weight overage funds for customer orders)

- Billing for your Freshline subscription

- Taxable items

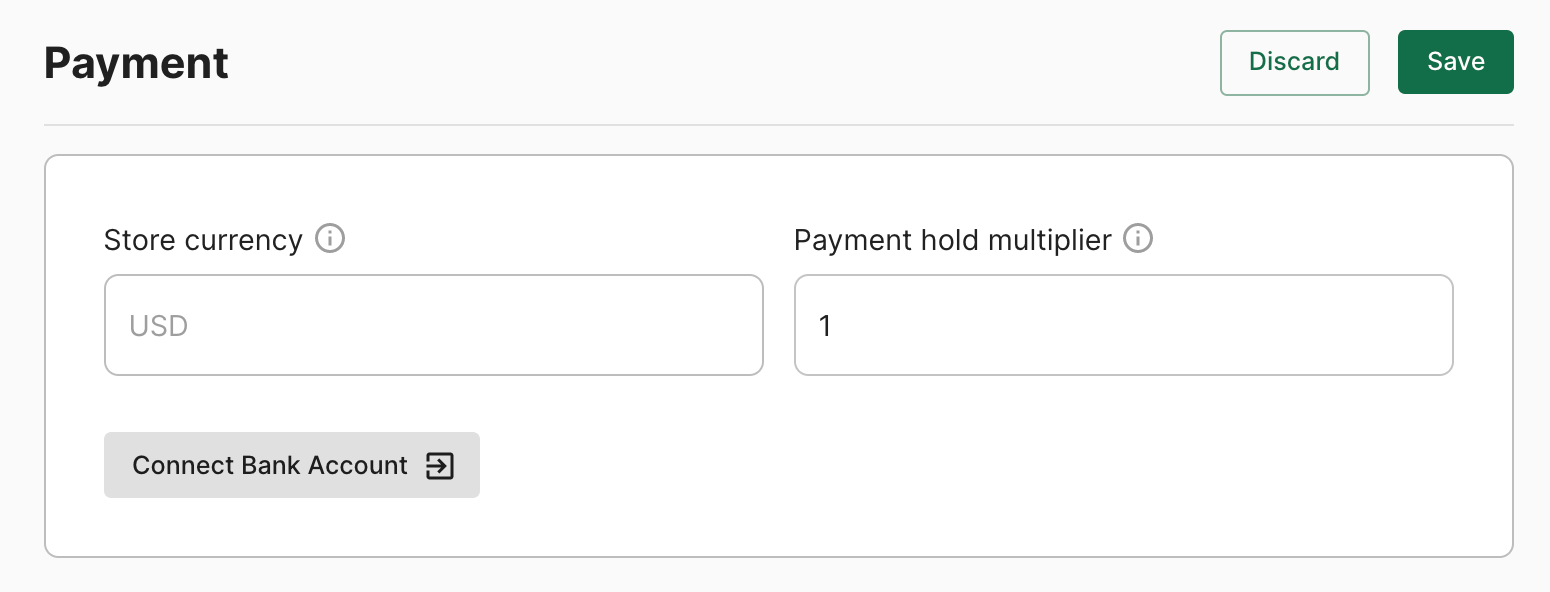

To set up your payment profiles, visit Account > Payment on your Freshline Dashboard.

Set up banking information

Setting up your banking information is a required step to processing payments and getting payouts. To get started, click Connect Bank Account under the top of the payments page.

This will prompt you connect your Bank Account to Freshline Payments. Complete the full walkthrough and ensure you see a message indicating that your account is successfully linked.

That's it!

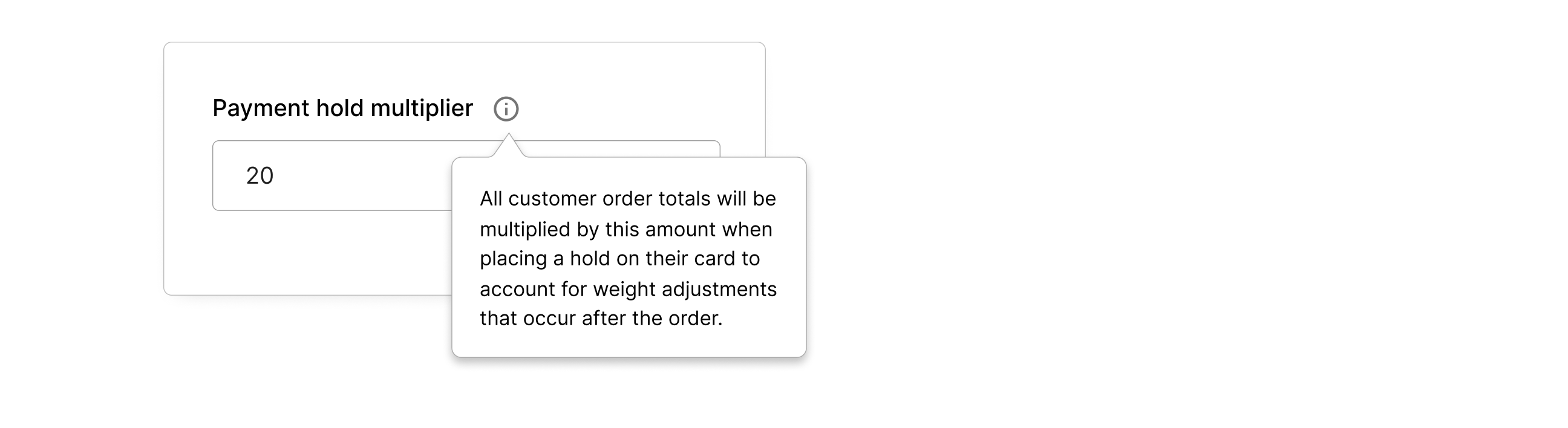

Set a payment hold multiplier

Your payment hold multiplier is used to account for items that may be shipped at a higher weight than what was ordered. A classic example would be selling whole fish, large steaks, or individual produce.

The value entered here will multiply a customer's order total by this amount and will pre-authorize (hold) this amount on their card.

For example:

Multiplier = 1: $100 order results in a temporary $100 authorization hold until the delivery or pickup date

Multiplier = 1.15: $100 order results in $115 authorization hold until the delivery or pickup date

You will then have up to the day of delivery or pickup to adjust weights. If not adjusted, the customer is charged the initial amount with the remainder refunded.

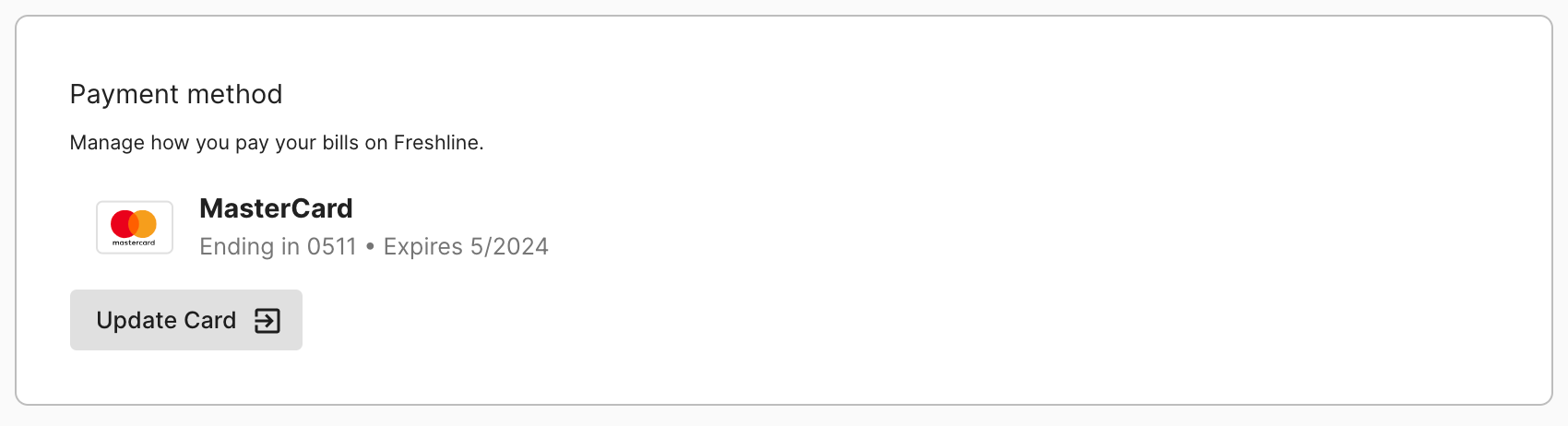

Add your billing information

Manage how your pay your bills on Freshline. Simply click Add Card and add in your billing details in your secure form.

You'll have access to all of Freshline's features at a low monthly cost.

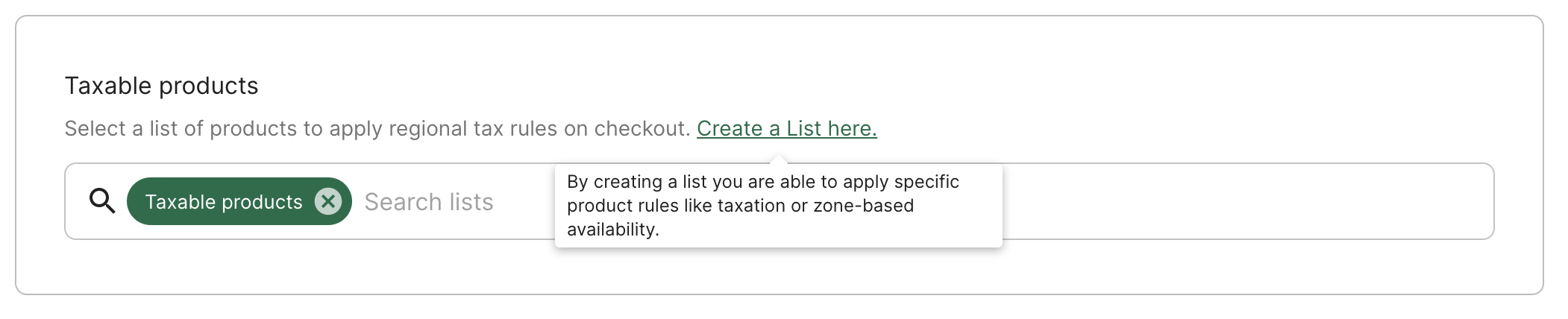

Choose a list of taxable items

If you're selling taxable items, you can choose the specific list to be taxed through the payments page. To get started:

1. Create a List of products that should be taxable via the Lists page.

2. Navigate to Account > Payment to select the taxable list.

3. Under Taxable products, search for the list you recently created and select the dropdown.

4. When you've finalized your selection, click Save.

The list of items specified will now automatically be taxed relevant regional taxes, based on users' delivery or pickup addresses.